nebraska sales tax calculator by address

This includes the rates on the state county city and special levels. The average cumulative sales tax rate in Grand Island Nebraska is 75.

Sales Tax On Grocery Items Taxjar

Call Us 866-400-2444.

. Omaha has parts of it located within Douglas County. Maximum Local Sales Tax. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with.

Demonstration of Filing State and Local Sales and Use Taxes Form 10 - Single Location Current Local Sales. For example lets say that you want to purchase a new car for 60000 you would. Nebraska State Sales Tax.

Nebraska State Sales Tax. Average Local State Sales Tax. Maximum Possible Sales Tax.

The most populous county. Form 10 and Schedules for Amended Returns and Prior Tax Periods. The average cumulative sales tax rate in the state of Nebraska is 605.

Apply more accurate rates to sales tax returns. We are happy to offer it free of use for. Lincoln is located within Lancaster County.

Free sales tax calculator to lookup the sales tax rate and calculate sales tax by address or zip code in the US. So no matter if you live and run your business in Nebraska or live outside Nebraska but have nexus there you would charge sales tax at the rate. Lincoln in Nebraska has a tax rate of 725 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Lincoln totaling.

Lincoln Sales Tax Rates for 2022. With local taxes the total sales tax rate is between 5500 and 8000. Sales and Use Tax.

The average cumulative sales tax rate in Omaha Nebraska is 686. This includes the rates on the state county city and special levels. This includes the sales tax rates on the state county city and special levels.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated. Maximum Possible Sales Tax. Average Local State Sales Tax.

Nebraska is a destination-based sales tax state. Find your Nebraska combined state. Grand Island is located within Hall.

ArcGIS Web Application - Nebraska. Request a Business Tax Payment Plan. Maximum Local Sales Tax.

Make a Payment Only. The base state sales tax rate in Nebraska is 55. Get information about sales tax and how it impacts your existing business processes.

The Nebraska state sales and use tax rate is 55 055. This takes into account the rates on the state level county level city level and special level. The state sales tax rate in Nebraska is 5500.

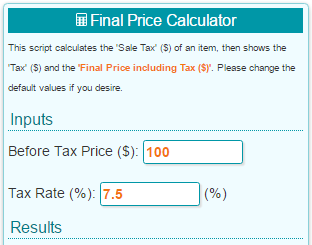

Quickly learn licenses that your business needs and. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. You can calculate the sales tax in Nebraska by multiplying the final purchase price by 055.

The Nebraska NE state sales tax rate is currently 55. Sales Tax Rate Finder. The average cumulative sales tax rate in Lincoln Nebraska is 688.

With local taxes the total sales tax rate is between 5500. The Nebraska state sales and use tax rate is 55 055. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75.

Sales Tax Calculator Credit Karma

New Jersey Nj Tax Rate H R Block

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Car Tax By State Usa Manual Car Sales Tax Calculator

Nebraska Sales Use Tax Guide Avalara

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

State And Local Sales Tax Rates Sales Taxes Tax Foundation

State And Local Sales Tax Rates Sales Taxes Tax Foundation

Nebraska Sales Tax Small Business Guide Truic

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Item Price 190 Tax Rate 8 Sales Tax Calculator

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free